MT940 Format

What is MT940 Format?

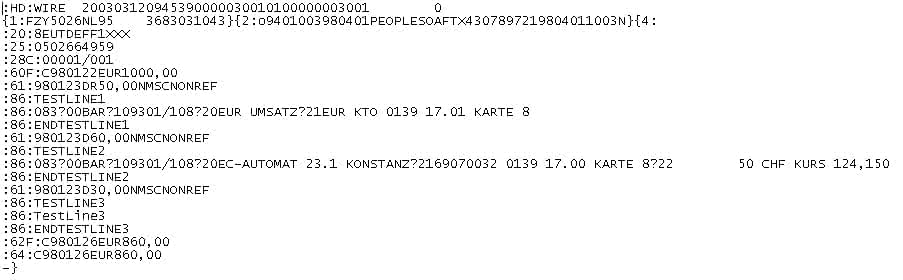

You may ask what is MT940? Well, a SWIFT MT940 file is a common bank statement file across Europe. S.W.I.F.T. (or SWIFT) stands for Society for Worldwide Interbank Financial Telecommunication. It was established by European bankers who needed a more efficient and secure system for inter-bank communications and transfer of funds and securities. SWIFT messages are pre-set and referred to by category numbers called MT numbers. Cashbook has an integrated SWIFT MT940 software solution that allows companies to upload a bank statement and algorithms are applied so that cash receipts and manual payments are automatically applied to customer invoices. The MT940 format software module can automate anything from 60-98% of your daily cash transaction.

SWIFT MT940 File Upload

The process begins with uploading an MT940 format bank statement into the Cashbook MT940 format software module. Some bank files do not provide standard, mandatory reference data records, specifically record 86, in the MT940 file format. Bank contacts should be requested to improve the data supplied.

This MT940 software module can be implemented in the Benelux region or anywhere across Europe. Our experience has been excellent (70-90% automation) in Sweden, Finland, Norway, Germany, Switzerland, Austria, and The Netherlands; France and Belgium (30-50% automation). Across the U.K., the auto-matching results are more limited (10-20% automation) due to the quality of the bank statement data. The good news is with SEPA changes our auto-matching with the SWIFT MT940 files has improved.

Features of the MT940 software

- JDBC access to multiple ERP systems, either directly integrating with system data or via staging databases.

- Uploads and stores multiple bank accounts, bank statement numbers, and opening and closing

bank balances. - Reports on all cash are automatically applied and manually matched.

- Can recognize alias MT940 file information that is incoming to improve auto-matching and not upload specific bank account details.

- Caters for partial payments, credit/debit notes, unallocated payments, multiple discount terms, foreign exchange gain or losses, write-offs, bank charges, and suspense account postings.

- Integrated with other Cashbook cash management solutions such as MT940 format in Excel, EDI, PDF, Lockbox Processing Modules, and Bank Reconciliation software modules. This enables usage with high and low-volume customers.

- Multiple sites, environments, or ERP systems can be catered for.

- Where MT940 codes or ‘character strings’ are used to identify transaction types and/or amounts – example ‘SKT’ = discount – we will automatically code these references to specific ledger accounts.

- Ability to view all MT940 bank statement information through Cashbook journals.

Benefits of the MT940 software

- Elimination of manual MT940 file processing allows companies to allocate more staff time to other higher-value activities.

- Creates the ability to run Shared Service Centres without the need for a common ERP system platform or version updates.

- Global companies can employ a global MT940 software solution for all sites across multiple banks.

- The MT940 module can automate anything from 60-98% of your daily cash transactions.

- Using MT940 codes or other bank codes, Cashbook can automate the workflow or transaction code of 100% of your daily transactions.